NASCAR Charter Market: Who’s Moving (and Who’s Fighting)

Roush Fenway Keselowski (RFK) Racing

RFK has already made its move, leasing a charter from Rick Ware Racing to field a third Cup car—the No. 60 driven by Ryan Preece in 2025—bringing him firmly into the Cup Series fold.

With this success under their belt, RFK is expected to pursue a permanent charter if and when additional charters become available on the market.

Legacy Motor Club

Legacy Motor Club, which already holds two charters, is currently in legal dispute with Rick Ware Racing over an agreement to purchase a third charter for 2026. A judge recently issued a temporary restraining order preventing Rick Ware from selling the charter to a third-party pending further legal resolution.

If successful, Legacy plans to position Jesse Love in a full-time Cup ride using that charter.

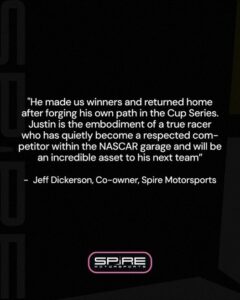

JR Motorsports

Known for its dominance in the Xfinity Series, JR Motorsports has quietly dipped its toes into Cup waters by fielding the No. 40 car driven by Justin Allgaier at the 2025 Daytona 500—but with no further races yet announced.

They are rumored to be exploring long-term Cup plans, potentially stepping in as a buyer if charters become available.

Front Row Motorsports (FRM) & 23XI Racing

These two teams are locked in a high-stakes legal battle with NASCAR. Both initially secured an injunction allowing them to use charters transferred from Stewart-Haas Racing, but that ruling was later overturned, forcing them to race as open entries—without guaranteed spots, revenue, or payouts.

Both teams insist the loss of charter status could push them toward financial collapse. Their lawsuit accusing NASCAR of monopolistic behavior continues, with key court proceedings—including a December trial—looming.

23XI to Stay at Three Cars

Despite the litigation fallout, 23XI Racing intends to maintain its three-car operation, continuing with drivers Bubba Wallace, Riley Herbst, and Tyler Reddick.

Andretti Global, Dodge, Ram, and Action Express Racing

Though not yet mainstream in NASCAR’s charter market, these entities are being whispered about as potential bidders should charters become available—indicating the sport’s growing appeal to outside manufacturers and manufacturers-adjacent teams.

Summary: Who’s Doing What

Team / Organization

Current Status & Intent

RFK Racing

Has a leased charter; likely to seek a permanent one

Legacy Motor Club

Suing to secure a third charter for Jesse Love

JR Motorsports

Testing Cup ambitions; monitoring charter availability

Front Row & 23XI Racing

In legal battle; currently racing as open (no charters)

23XI Racing

Committed to remaining a three-car team

Andretti, Dodge, Ram, Action Express

Potential new entrants—eyeing charters if available

The Stakes & Wider Implications

Guaranteed Entry & Revenue: Charters provide entry into every race, stable payouts, and easier financial planning. Without one, teams like FRM and 23XI risk losing sponsors, drivers, and viability. Litigation as Leverage: The antitrust lawsuit and associated motions reflect a deep split between NASCAR and two of its teams. The outcome, expected in December, could reshape how charters are negotiated—or contested in court. New Blood in NASCAR: The potential entry of global brands like Andretti, or OEMs such as Dodge or Ram, signals a new era where manufacturers may re-enter or expand their commitment to NASCAR.

Final Word

The NASCAR charter market is turning into a battleground—one that could reshape team landscapes for years to come. RFK is making bold moves through leasing and expansion. Legacy Motor Club is fighting to seal its rise. JR Motorsports is quietly gearing up. FRM and 23XI are fighting for survival amid legal uncertainty. And a wave of potential new entrants waits in the wings.